May 2024 Market Update

- Steven Reinisch

- May 31, 2024

- 4 min read

The U.S. economy runs on housing and credit. In last month’s market update we explained that market participants are currently not requiring compensation for adding credit and duration risk and that corporate debt and credit markets appear to be in their largest bubble of the past thirty years. While economic growth slows and unemployment rises, credit spreads and market volatility should rise. In this months market update we are going to explain why housing faces potential headwinds in the months ahead.

The health of the housing market is beginning to come under question, which is a major catalyst for overall employment. Permits to build new single-family homes are declining. And while single family permits lead single family units under construction, if permits continue to decline, single family units under construction will decline, which in turn leads to residential construction employment declining.

For the housing market to remain strong, new single-family home sales need to rise so that the monthly supply of homes does not rise and force price cuts for new single-family homes and job cuts for homebuilders, in the months ahead.

The largest driver of economic growth is demographics. The U.S. is experiencing a steep decline in the working age population growth rate. This decline puts downward economic pressure on aggregate incomes as well as consumer demand and single-family housing permits. Many are shocked to learn that the American home ownership rate peaked in 2005, right around the time the working age population growth rate peaked, and the national debt began to surge.

Births in the U.S. have been falling consistently since 2007. The former rate of American home ownership as well as the level of single-family housing permits has never recovered. This is bad news for long term economic growth and dynamism and will require pro-family policies to address declining birth rates in an aging society, in the years ahead.

Because our working age population growth rate is in serious decline, Americas engine of economic growth (real GDP) is also set for decline. The economic growth rate is what upholds asset valuations and asset valuations are what retired and working age Americans depend on to plan and live comfortably. If Americas economic growth rate falls, the current high valuations of American assets are no longer protected.

This morning, the Chicago PMi data reported another decline, remaining in recessionary territory at 35.4 and down from the April level of 37.9. This is the lowest Chicago PMi level since 2020. As discussed before, this data is highly correlated to S&P500 forward earnings growth estimates.

The U.S. economy is not headed in the right direction. And although promises of future government spending are keeping economic hopes elevated and asset valuations high, the structural issues America faces in maintaining long term economic growth such as, a declining working age population and birth rates, wealth inequality, illegal immigration, aging infrastructure, rising national debt and declining economic mobility, cannot be fixed by simply expanding the money supply.

In fact, expanding the money supply has exacerbated these structural issues. Keep in mind that the government has a history of incredibly low return on investment while also producing inflation. Real median household income is at a 5 year low, slightly above 2018 levels. We believe economic data will prove to policy makers that simply expanding the money supply to fix structural economic growth issues only provides a self-defeating outcome.

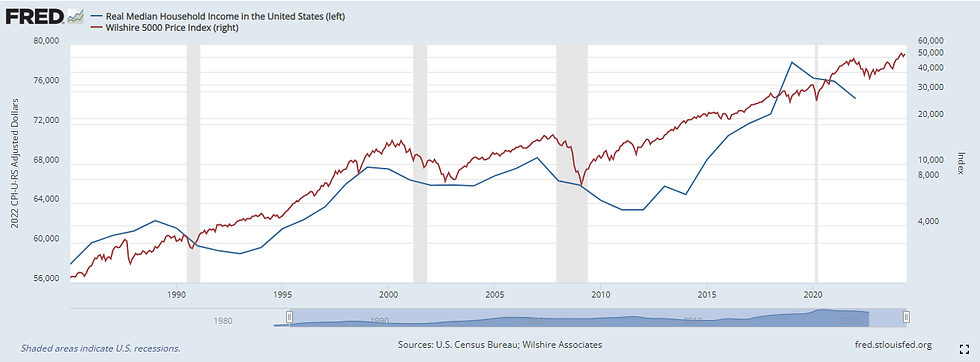

Below is a chart depicting the relationship between real median household income and stock market returns. The lost decade which occurred between 2000-2010, where bonds outperformed stocks, was defined by a period of stagnant real median household income growth. Valuations for stocks fell during this period while bond investors did well.

For the reasons mentioned above, our recommendation since January of 2023 has been to position portfolios to endure a recession, in a defensive manor, risk off and in cash, T-bills, money market funds, fixed income duration extended in September 2023 from 0-5 year to 0-30-year U.S. Treasury bills and notes, 10-year minus 2-year yield curve re steepening and select low duration U.S. equities. Getting paid to wait for growth assets to be priced at discounts, while being positioned to benefit from bond price appreciation as interest rates decline from downward economic pressure, continues to be a profitable and rewarding strategy.

We remain patient and focused on managing risk through 2024.

Disclosure: Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results. This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Macrovex Capital, LLC to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection, and forecasts. There is no guarantee that any forecast made will materialize. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Macrovex Capital, LLC financial advisor to ensure that any contemplated transaction in any securities or investment strategy aligns with your overall investment goals, objectives, and tolerance for risk. Additional information about Macrovex Capital, LLC is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD #300692. Macrovex Capital, LLC is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice

Comments