April 2023 Market Update

- Steven Reinisch

- Apr 19, 2023

- 4 min read

The S&P 500 has rallied from 3810 to 4175 since the banking crisis unfolded in the middle of March. After the Federal Reserve stepped in with a new liquidity facility to assist the banks the markets quickly returned to casino-like conditions.

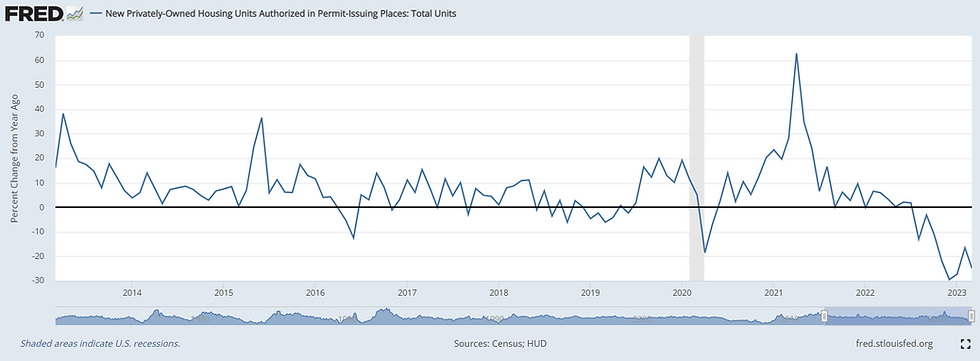

Many on Wall Street are calling this the next QE (quantitative easing) cycle, arguing for a pickup in the M2 money supply, stemming from broad based credit creation across an improving economy. This could also mean that inflation would once again be on the rise. This view runs counter to the data trends of many key leading economic indicators. Indicators such as the ISM Manufacturing Index, Chicago PMI, ISM New Orders, NAHB, building permits, housing starts, retail sales, NFIB small business survey and consumer sentiment. Leading employment indicators such as continuing unemployment claims, have climbed higher since August of last year. Permanent jobs losses, which are known to rise in recessions have risen to their largest level since Q3 of 2020. The case for recession continues to build as the impact of Fed rate hikes comes with long and variable lags to the overall economy.

The Federal Reserve has not restarted quantitative easing, as those on Wall Street have indicated. Fed meeting minutes from the March meeting recently disclosed that all members of the FOMC committee voted in favor of continuing the reduction of the Federal Reserve’s balance sheet. As previously mentioned in our March Market Alert https://www.macrovex.com/post/market-alert, stockholders will not be saved. Bank equities can fail. As assets across the economy adjust to new valuations resulting from higher interest rates there will likely be more problems arising in banking and real estate that leads to a contraction in credit. A credit contraction would likely reduce demand and send the U.S. economy into recession.

So, what’s the conundrum? Why won’t stock prices respond to the data? Inflation is still an issue and there is simply too much money chasing too few profitable stocks, while at the same time the market is pricing in rate cuts. The pricing in of rate cuts tells the market that stocks should trade at a higher price to earnings multiple rather than a lower one. In addition, this causes Wall Street analysts to refrain from cutting future earnings estimates and therefore the market refuses to price in a recession. While this continues to occur, the market continues to become more and more expensive on a fundamental basis.

The market is putting the cart before the horse pricing in a Fed pivot/rate cut, before the economy experiences a meaningful amount of job losses. The Fed has defined the unemployment rate level they would need to see breached to begin to get them nervous at 4.5%. The unemployment rate fell this past month from 3.6% down to 3.5% and yet the market still expects interest rate cuts. So long as the market expects cuts, and those expectations push stock prices up, Fed policy can remain restrictive. When the 10-2’s yield curve re steepens, 10-year breakeven inflation rates typically fall faster than 10-year nominal rates. This forces real rates to rise at the onset of deflation. Which in our opinion eventually drives 10-year real rates higher and earnings and valuations lower.

In a recession households retrench, incomes decline, inventories build and businesses lower prices. These are the conditions necessary for the Fed to see before considering changing course and cutting interest rates. Until then the Fed is continuing to focus on its mandate of achieving price stability and restoring inflation back to the 2% target.

With the S&P 500 trading around 4175 we continue to believe investors will be rewarded by being positioned risk off and in cash, short term interest rates, 0–5-year U.S. Treasury bills and notes, money market funds, 10-year minus 2-year yield curve re steepening and select low duration equities.

Disclosure: Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Macrovex Capital, LLC to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection, and forecasts. There is no guarantee that any forecast made will materialize. Reliance upon information in this letter is at the sole discretion of the reader.

Please consult with a Macrovex Capital, LLC financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives, and tolerance for risk. Additional information about Macrovex Capital, LLC is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary report which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD# 300692. Macrovex Capital, LLC is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Comments